MyIR Online access to your tax data in New Zealand

In order to be able to access your tax data in New Zealand yourself, or to change your data, you should register for free while you are in New Zealand.

The service is provided by the IRD (Inland Revenue Department) of New Zealand and is important for everyone working in New Zealand. In the MyIR portal you can easily change your data yourself, or check if your employer has transferred the correct amounts.

How does the registration at MyIR work

In the course of the tax return or arising questions for the Inland Revenue Department I have the following tips.

In any case, register with your IRD on the website of the Inland Revenue Department for the online service MyIR.

How to do this is explained briefly here.

- Go to the website of the Inland Revenue Department and look on the right side. If you are not registered yet, go to “Register”.

- Now you have to choose that you want to have a personal MyIR account.

- When you go to “Create Account now” you will be asked for your IRD. You must already have this.

- Enter your personal data and do everything to activate your account. The most important thing you have done now.

What you can do with the account

Under MyIR you can do the following things after logging in:

- If you want to see regularly how much money you have already earned and how much tax you have paid.

- You can send messages and questions directly to the Inland Revenue Department.

- You can calculate if you have paid too much tax.

- You can view and change your personal data.

Where you can review your income

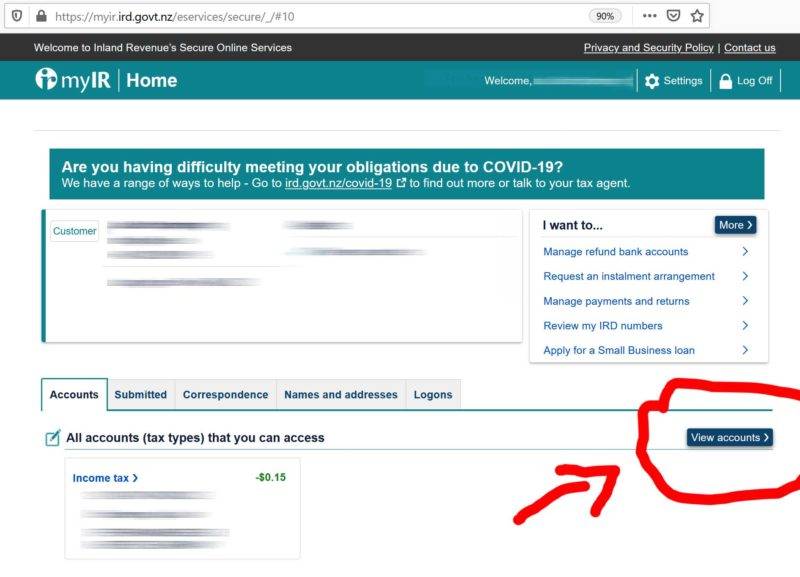

- Go to the IRD website (ird.govt.nz) and log into your MyIR account.

- Click on the tab “View Accounts” on the bottom right of the page.

View Accounts

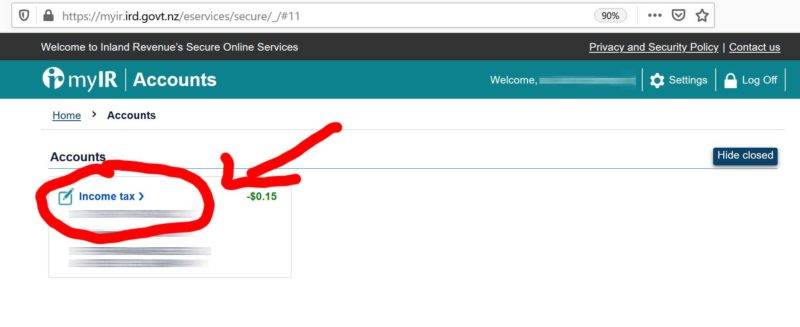

- Click on the “Income Tax” tab in the account selection.

Income Tax

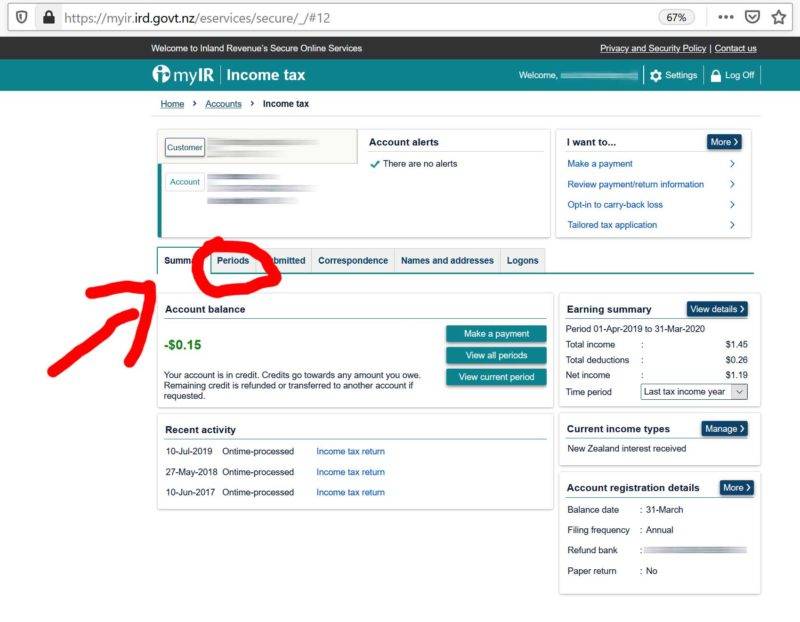

- After that you land in a summary. There you have to select the tab “Periods”.

Periods

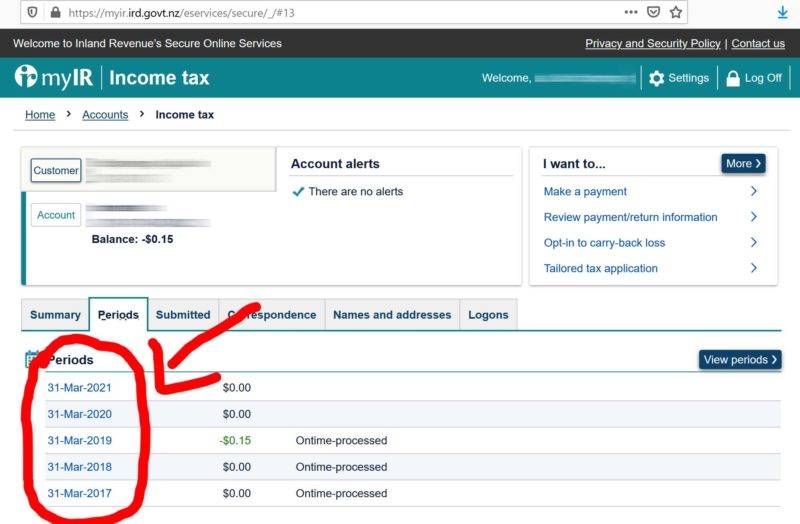

- In the section “Periods” you get a selection of all tax years in which you can see all income. Click on the time frame you want to have a closer look at. The New Zealand tax year is always from 1.4. – 31.3.

Choose your tax year

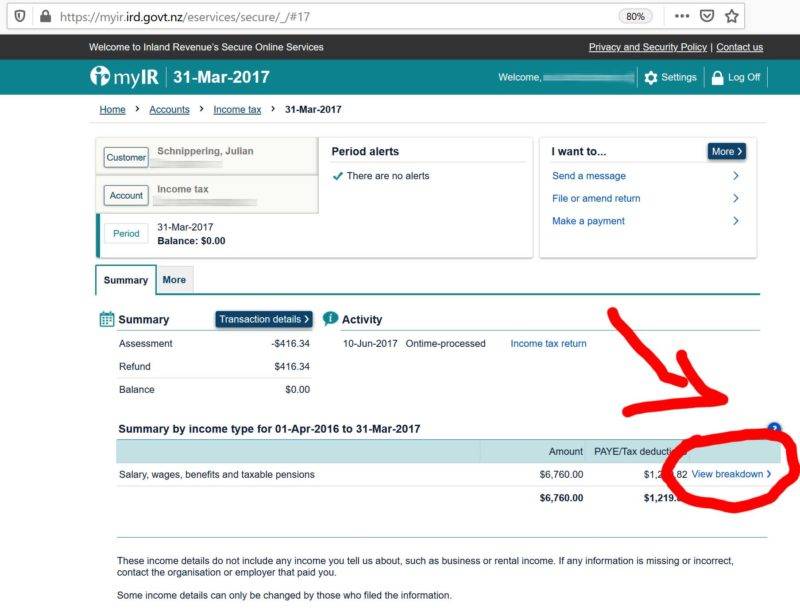

- In the explanation of the respective tax year you will then get an overview. Under Amount you will see a line with the description “Salary, wages, benefits and taxable pensions”. There you can see how much income you have received from your salary and how much tax has been deducted from it. If you click on “View breakdown” you will see more details.

View breakdown

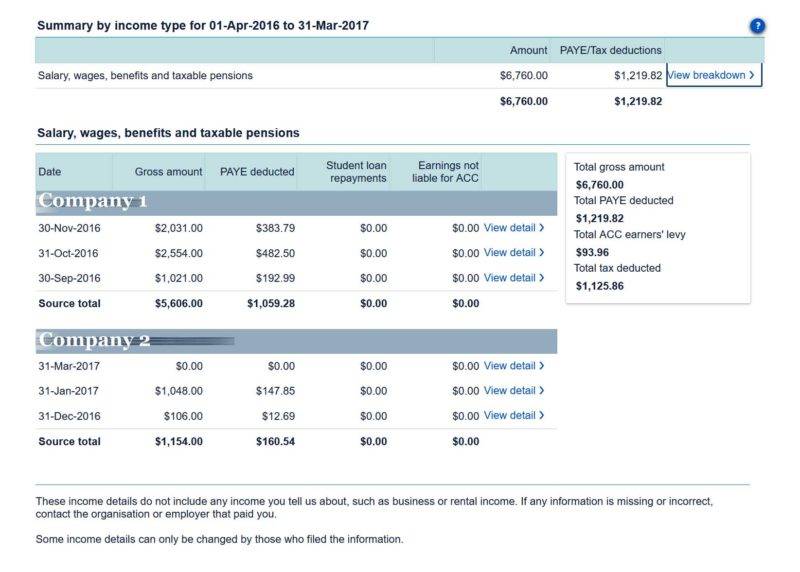

- In the “Breakdown” you can see every single employer who has (or had) you. You will also see the income per month and the deductions for tax and ACC. If you click on “View Detail” again after the respective month, you will see more details. Note that your employer must have reported your monthly income on the 20th of the following month. For example, if you worked in March, this income must not be visible in the MyIR tool until April 20.

View Details

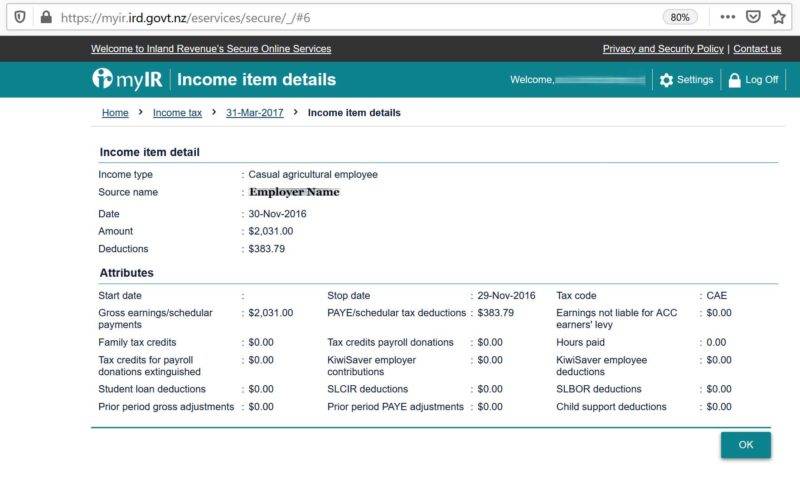

- Here you can see all details, income type, date and much more. Here you can also check which tax code your employer has registered for you.

Employment details

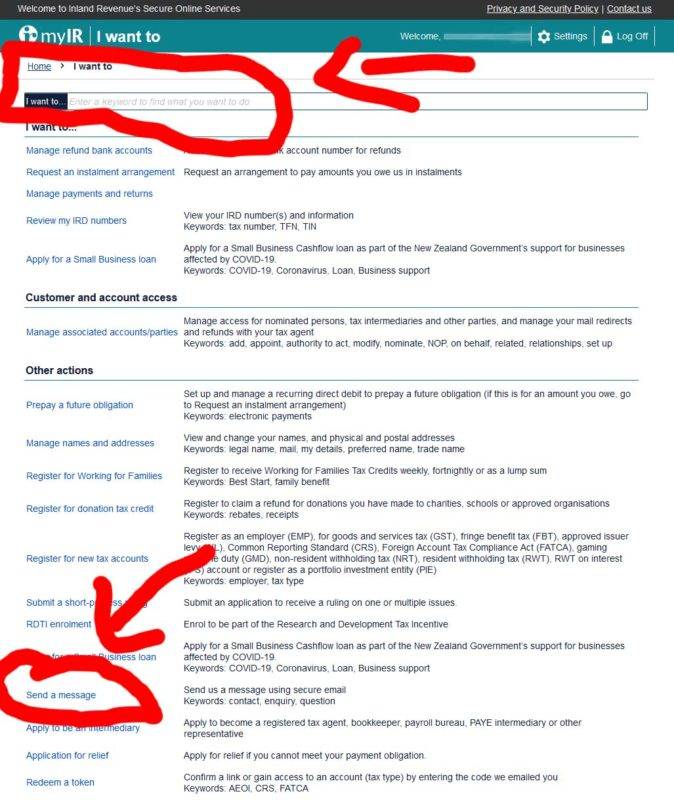

How to send a message to the IRD

Are you looking for a way to send a message or e-mail to the IRD? No matter if you have a question or if you want to share information, you can do it all here in the MyIR portal. Here we explain how you can send a message to the IRD. The only condition is access to MyIR.

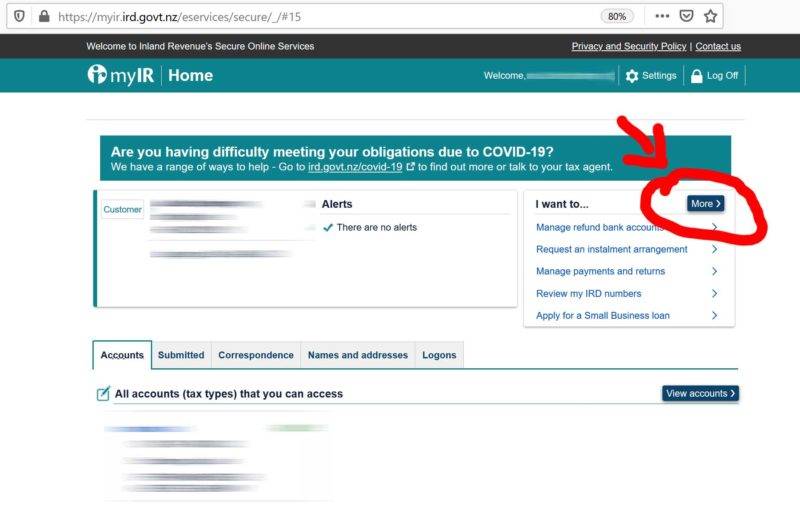

- Log into the MyIR portal on the IRD website.

- Click on “More” on the right side after “I want to”.

More

- Then you can either type the word “Message” into the search bar at the top of the page. Or you can scroll down in the list to the point “Send a Message”. Click on this item.

Send a message

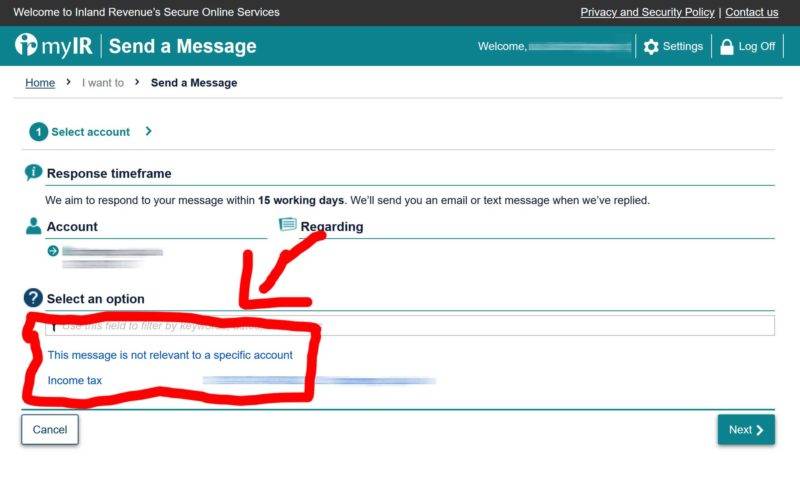

- After that you select below which account it concerns. In most cases it concerns your “Income Tax”. Click on this one.

Choose your account

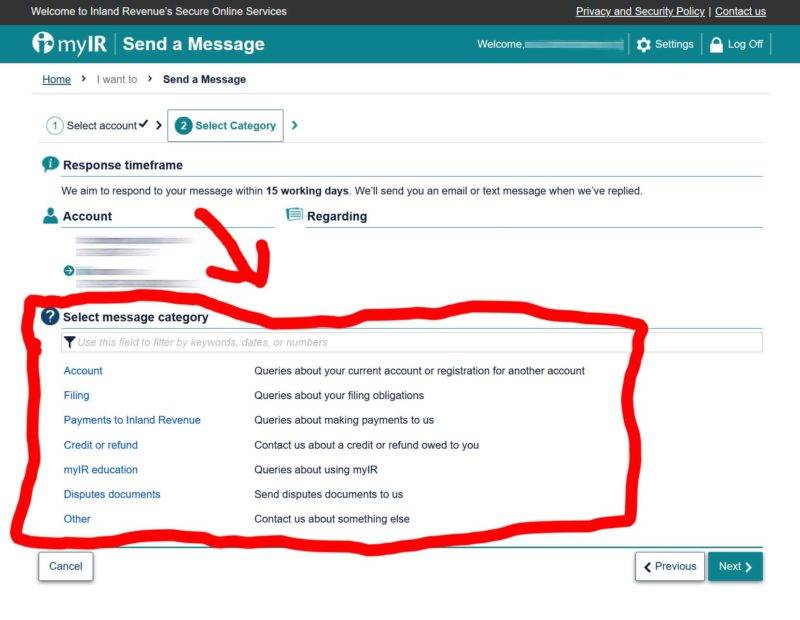

- Select the message category, so that the message goes to the right team of the IRD.

Choose message category

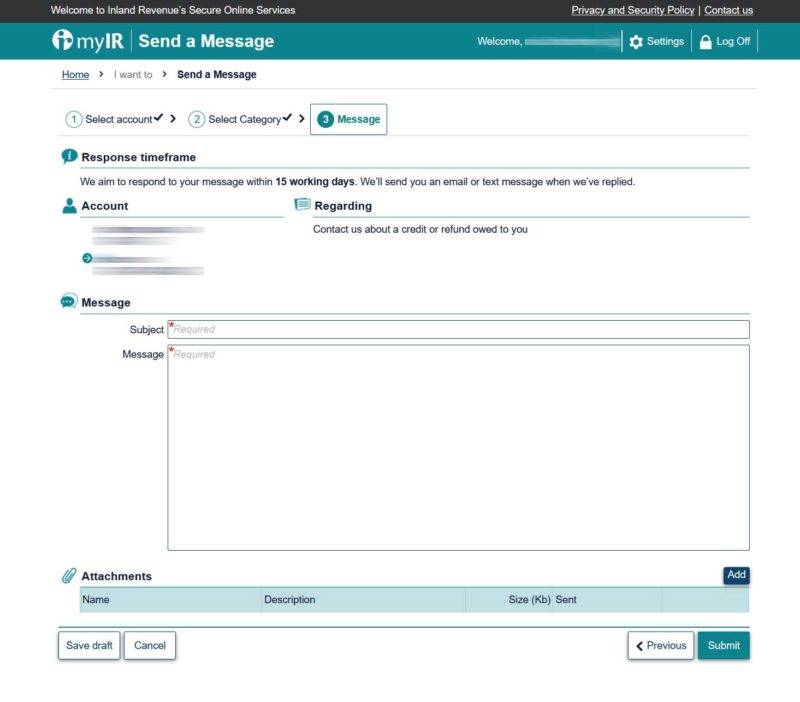

- After that you will get to a message field. There you can enter the headline and the message in English. If you need a translation tool, we have had good experience with the translation website Deepl (link deepl.com). Depending on the current workload, the IRD will tell you how long a reply will probably take.

Subject & Message

- If you need a faster answer, you should call us. From abroad you can do this cheaply via Skype. Within New Zealand free from a landline. You can find the IRD phone numbers here on the IRD website.

Questions about the MyIR tool

You have further questions about MyIR? Feel free to write us a comment here under the blog post. Then we can see if we can help you. In the MyIR tool you can-do all-important settings for your tax in New Zealand yourself.

More information about tax in New Zealand

More information about taxes and how to do your tax return can be found here in our blog.

Ask us anything

We run this blog so you can have a great time in New Zealand. All the articles and videos are free for anyone.

If you want to ask an individual question about Newzealand, your working holiday or anything else around travelling New Zealand, then this is your chance.

Even it always looks like holiday, this website and the project is a fulltime business. So you can support us with any question if you'd like.

Simply click the button and ask us, in exchange for your answer you can give what you value our time.

If every visitor would support us with 1€ per year, our business would be up running for long times. Therefore we count on your support!

A big thank you from the depth of our hearts. Julian & the team of Project-Newzealand

3 Comments